Thursday 29 September 2011

US Debt in Household Budget Terms

By removing several zeros from the Government's figures and rephrasing the official terminology, one can place the debt situation in terms we all can understand - that of a family’s income and expenses.

A family taking in an annual income of $21,700 but spends $38,200 will soon be in dire straights.

The large outstanding balance of $142,710 on the credit card only exacerbates the situation.

Clearly, spending cuts need to be made, but eliminating only $385 from the family’s budget would be a drop in the bucket.

Either a substantially higher amount of income needs to be made, or the family will have to learn to live with less.

Clearly, this "family's" credit status is beyond alarming. The parents must accept the responsibility that has led up to their predicament and avoid shunting the repayments to the kids.

It's not all hopeless... in the household context, by all means start paying down the credit card debt and start managing the card company's expectations by committing to repaying an affordable amount each month. Alongside this, the long road to redemption must also start with initiating some nominal savings to weather the inevitable storms that will appear. Assets like precious metals eg silver should act as a store of value in the long term. Currently priced at around US$30 an ounce, they are worth accumulating.

Labels:

Creditors;,

US Crisis,

wealth

Saturday 17 September 2011

China's WEF warning on its US Treasury sovereign debt holdings...orderly liquidation...

China has explicitly warned the debt markets...

A key rate setter for China's central bank let slip, or was it a slip, that Beijing aims to run down its portfolio of United States debt as soon as safely practicable.

"The incremental parts of our of our foreign reserve holdings should be invested in physical assets," said Li Daokui at the World Economic Forum in the very rainy city of Dalian, formerly Port Arthur from Russian colonial days. Mr Li, one of three outside academics on China's Monetary Policy Committee, described the debt deals on Capitol Hill as "just trying to by time", saying it will not be enough to stop America's "debt dynamic" turning dangerous.

"We would like to buy stakes in Boeing, Intel, and Apple, and maybe we should invest in these types of companies in a proactive way."

"Once the US Treasury market stabilizes we can liquidate more of our holdings of Treasuries," he said.

It appears this is the first time a top adviser to China's central bank has uttered the word "liquidate". Until now the policy has been to diversify slowly by investing the fresh US$200bn, on average, accumulated each quarter into other currencies and assets, mainly AAA euro debt from Germany, France and the hard core.

It is not clear how much US debt is held by SAFE (State Administration of Foreign Exchange), the Chinese central bank's forex arm. The figure is thought to be over US$2.2 trillion. What's clear is a large vexed seller is agog to let go.

The relevant ETF (NYSE: TBT) to capture this directional move, as confidence in US Treasuries slowly erodes, is the ProShares UltraShort 20+ Year Treasury; it seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Bond Index (the Index).

A key rate setter for China's central bank let slip, or was it a slip, that Beijing aims to run down its portfolio of United States debt as soon as safely practicable.

"The incremental parts of our of our foreign reserve holdings should be invested in physical assets," said Li Daokui at the World Economic Forum in the very rainy city of Dalian, formerly Port Arthur from Russian colonial days. Mr Li, one of three outside academics on China's Monetary Policy Committee, described the debt deals on Capitol Hill as "just trying to by time", saying it will not be enough to stop America's "debt dynamic" turning dangerous.

"We would like to buy stakes in Boeing, Intel, and Apple, and maybe we should invest in these types of companies in a proactive way."

"Once the US Treasury market stabilizes we can liquidate more of our holdings of Treasuries," he said.

It appears this is the first time a top adviser to China's central bank has uttered the word "liquidate". Until now the policy has been to diversify slowly by investing the fresh US$200bn, on average, accumulated each quarter into other currencies and assets, mainly AAA euro debt from Germany, France and the hard core.

It is not clear how much US debt is held by SAFE (State Administration of Foreign Exchange), the Chinese central bank's forex arm. The figure is thought to be over US$2.2 trillion. What's clear is a large vexed seller is agog to let go.

The relevant ETF (NYSE: TBT) to capture this directional move, as confidence in US Treasuries slowly erodes, is the ProShares UltraShort 20+ Year Treasury; it seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Bond Index (the Index).

Monday 5 September 2011

English collective nouns…a school of fish, parliament of owls, pride of lions, Congress of baboons…making the world go round.

The English language has some delightfully anthropomorphous collective nouns for the various groups of animals.

We are all familiar with a herd of cows, a flock of chickens, a school of fish and a gaggle of geese.

However, less widely known is:

- a pride of lions,

- a murder of crows (as well as their cousins the rooks and ravens…recall the 1963 Alfred Hitchcock film "The Birds"?)

- an exaltation of larks and,

- presumably because they look so wise, a parliament of owls.

Now consider a group of baboons. They are the loudest, most dangerous, most obnoxious, most viciously aggressive and least intelligent of all primates. Ironically, what is the proper collective noun for a group of baboons? Believe it or not... a congress!

Dedicated to the politicians of the world…especially to those on both sides of the Atlantic responsible for the current global economic woes and specifically, to that collective crew in Washington DC who literally personify this noun.

Against this backdrop, with the scope for fiscal and monetary policy ammunition running desparately short and stimulus all but exhausted, politicos might be expected to grasp the nettle, overcome their squeamishness about confronting vested interests opposed to change and push through reforms to improve the supply side of the economy; policies such as making it easier to hire and fire, promoting greater competition and investing more in training.

How about the people deserving a keen "convocation of eagles" in these national legislatures...

We are all familiar with a herd of cows, a flock of chickens, a school of fish and a gaggle of geese.

However, less widely known is:

- a pride of lions,

- a murder of crows (as well as their cousins the rooks and ravens…recall the 1963 Alfred Hitchcock film "The Birds"?)

- an exaltation of larks and,

- presumably because they look so wise, a parliament of owls.

Now consider a group of baboons. They are the loudest, most dangerous, most obnoxious, most viciously aggressive and least intelligent of all primates. Ironically, what is the proper collective noun for a group of baboons? Believe it or not... a congress!

Dedicated to the politicians of the world…especially to those on both sides of the Atlantic responsible for the current global economic woes and specifically, to that collective crew in Washington DC who literally personify this noun.

Against this backdrop, with the scope for fiscal and monetary policy ammunition running desparately short and stimulus all but exhausted, politicos might be expected to grasp the nettle, overcome their squeamishness about confronting vested interests opposed to change and push through reforms to improve the supply side of the economy; policies such as making it easier to hire and fire, promoting greater competition and investing more in training.

How about the people deserving a keen "convocation of eagles" in these national legislatures...

Saturday 3 September 2011

US jobs recovery has stalled...is a Greater Depression beckoning as financial crisis continues unabated...a possible jobs solution...

Ahead of the US Labour Day holiday weekend, the Labour Department's latest employment non-farm payrolls report for August, issued yesterday, makes for grim reading showing zero job growth with unemployment transfixed at 9.1% (14 million people).

President Obama has convened an "emergency" jobs speech before a joint session of Congress on 8 September.

Recent sagging consumer confidence and skittish businesses' reluctance to hire underscore the severity of the United States situation. The impact is also felt abroad right now by Asia exporters hurt by declining trade volumes. Consumer spending represents around 70% of US GDP (about US$ 14.7 trillion in 2010).

The tremendous stockmarket rallies triggered from March 2009 as company profits recovered have not translated into additional new jobs in the US.

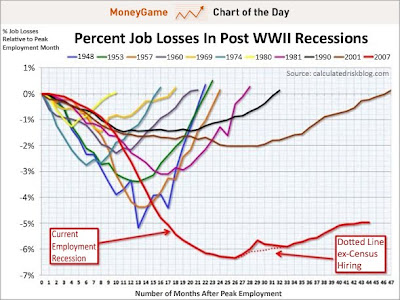

What the chart above (made by Calculated Risk) shows is the trajectory of job losses and gains over time, after employment peaked, during this recession(red line), compared to previous recessions.

So as you can see, the depth of the decline was much worse than any other recession. Furthermore, the pace of the recovery is much weaker than in previous ones. Over a year it was looking as though the recovery might be kind of V-shaped (a really big, wide V), but now it's clear that the comeback won't look anything like the decline. Now the comeback is basically flatlining. It's turning into a tilted "L".

Ironically, the only time in history that portrayed a much worse and protracted decline than the current one came about during the 1930s and 1940's Great Depression.

With current sovereign debt crises unresolved, both in the US and Europe, there is a danger of panic solutions being deployed by governments that may portend unintended consequences (eg. implementing QE3, Eurobonds) and exacerbate the uncertainty over further new job creation.

There is one possible solution which can foster job creation back in the US. Consider the current S&P500 companies' balance sheets hold cash of US$500+ billion. Unfortunately, a significant chunk of this cash is held in their overseas subsidiaries bank accounts which cannot be repatriated back to US shores, otherwise they would be immediately subject to US business tax of 35% (the 2nd highest in the world after Japan's 39.5%). Scrap this inane tax rule. Let these companies bring their hard-earned money back tax-free.

Let's do a rule of thumb calculation. Say, 40% of this cash, valued at US$200 billion, is held abroad. Repatriate this to the US and assuming dividend and share buy-back policies remain unchanged, it's all re-invested in high value IT and biotech industries, within key R&D, software / hardware manufacturing processes, where the US still retains a solid competitive advantage. That should generate 2 million critical US$100,000 jobs...and these intrinsically satisfying roles stimulate increased consumer spending (including derived demand for Asia exports), pep up family units and generate local taxes paid...

Surely it makes commercial sense to also consider relocating some of these overseas positions back to the United States than end up with incessant verbal spats over high-technology transfer agreements, patent thefts and infringements with some local partners in those testy countries...like China.

Subscribe to:

Posts (Atom)