The China Daily has reported China's homegrown Beidou Navigation Satellite System began providing initial positioning, navigation and timing operational services to China and its surrounding areas from 27th December.

Beidou is being developed to rival the

United States-developed Global Positioning System (GPS), the European Union's Galileo and Russia's

Global Navigation Satellite System, and is aimed at allowing travelers,

drivers and military officials to accurately know their locations.

The system will provide service with high

precision and credibility for industries and sectors including mapping,

fishery, transportation, meteorology and telecommunications.

To date, China has launched 10 satellites for the Beidou system, with the tenth being lifted into orbit earlier in December. Ran Chengqi, director of the management office of the China Satellite Navigation System, told a press conference 6 more satellites will be launched in 2012 to further improve the Beidou system and expand its service coverage across most parts of the Asia-Pacific region.

China began building the Beidou system in 2000 with a goal to break its dependence on the US GPS and so creating its own global positioning system by 2020.

The Beidou system is compatible and interoperable with the world's other major global navigation satellite systems, according to Ran. He also encouraged enterprises at home and abroad to join the research and development of application terminals compatible with Beidou, saying a beta version of the system's Interface Control Document (ICD) could be accessed online starting 27th December.

The onset of Beidou's operations expands China's reach beyond its borders and has profound implications in sectors like maritime trade and military development across the Asia Pacific space.

Tuesday 27 December 2011

Tuesday 20 December 2011

China Ningxia wines tops French Bordeaux in Beijing wine challenge...

In a blind winetasting competition in Beijing on December 14, five wines from Bordeaux and five wines from Ningxia - all priced in the range 200 - 500 yuan (RMB) - were wrapped in black cloth, tagged with a number, and served to ten French and ten Chinese wine judges. When the results were announced: the top four wines were Chinese!

The Ningxia vs Bordeaux Challenge was organised by Jim Boyce with website TasteV, wine club Zun, and Grape Wall contributors.

The wines were opened, tested for quality, bagged and tagged, in the presence of several reporters, under the supervision of Philip Osenton, who works with distributor Globus and is former head sommelier at Ritz London and restaurant manager for the Savoy. He and others, including the media, witnessed computation of the scores.

“Sacrilège,” screamed the headline of the French business daily, La Tribune. But the top French dailies, Le Monde and Le Figaro, seemed to suppress the news, quite understandably. The people have enough to worry about.

OK, French wines have been beaten with some regularity ever since the Judgment of Paris on May 24, 1976, when, to the utter and never fully digested shock of the French wine establishment, a Napa Valley Cabernet Sauvignon and a Chardonnay beat their Bordeaux counterparts - and put California on the international wine map.

The judges were asked to rank the wines from first to tenth based on quality. First place was worth one point, second place worth two points, and so on. The wines with the lowest total scores were the winners. The judges had spent 40 minutes tasting and ranking the wines and another 30 minutes discussing them.

The top five:

1. Grace Vineyard Chairman’s Reserve 2009 34 points (RMB 488)

2. Silver Heights The Summit 2009 42 points (RMB 416)

3. Helan Qing Xue Jia Bei Lan Cabernet Dry Red 2009 44 points (was RMB220, now pending)

4. Grace Vineyard Deep Blue 2009 46 points (RMB 288)

5. Barons de Rothschild Collection Saga Medoc 2009 54 points (RMB 350)

The Chinese judges:

- Ma Huiqin, professor at China University of Agriculture and wine marketing expert (head judge)

- Frankie Zhao, owner of Pro-Wine Consultancy

- Fiona Sun, senior editor at China edition of Revue du Vin

- Jin Yang, wine teacher who spent five years studying in Bordeaux wine programs

- John Gai, of wine distributor and bar operation Palatte

The French judges:

- Nicolas Carre, sommelier and wine consultant (head judge)

- Jerome Sabate, long involved as wine maker with Dragon Seal in Beijing

- Nathalie Sibillet, oenologist, journalist and teacher

- Thomas Briollet, seven years experience in China wine distribution

- Edouard Kressman, wine maker with experience in Bordeaux, California and Argentina

For now, the big takeaway is that Chinese wines have again - not for the first time, shown they can compete on a global level. The reality check: these wines represent a smidgeon of the China market and the industry as a whole still has a long way to go.

But who could have imagined a few years ago spending US$77 on a bottle of good Chinese wine to be shared over a romantic dinner? The French must have had similar thoughts about California wines in the aftermath of May 24, 1976.

More upheaval in the old world order...

Sunday 18 December 2011

China's 2011 holdings US Treasuries debt cut again in October

China trimmed its holdings of US Treasury debt by US$ 14.2 billion in October, driving its holdings to the lowest level this year.

This move to cut the US debt holdings indicated an attempt by the People's Bank of China (PBOC) to increase its cash holdings of dollars in order to shore up the value of the yuan.

The yuan has been faced with increasing downward pressure as investors sold the currency seeking a safe haven in the US dollar amid a grim outlook for the global economy.

China held a total of US$ 1,134 billion of US Treasury debt as of October 2011. According to the US Treasury Department, China accounted for approximately 24% of total foreign holdings of US debt. Despite this latest cut, China remains the largest foreign holder of US treasuries.

Analysts advocate China should continue to accelerate the diversification of its US$ 3.2 trillion foreign-exchange reserves, amid growing global financial uncertainty. Currently, about one-third of China's foreign-exchange reserves is invested in US Treasury bonds.

The PBOC has been reported it's planning to create a fund worth US$ 300 billion to invest the country's foreign-exchange reserves in the US and European markets. The fund will reportedly seek to invest in real assets and company shares, rather than government securities.

Gao Xiqing, vice-chairman of China Investment Corp, the country's sovereign wealth fund, said recently that the fund is actively looking for investment opportunities in infrastructure projects in countries including Britain, the US, and Brazil.

This move to cut the US debt holdings indicated an attempt by the People's Bank of China (PBOC) to increase its cash holdings of dollars in order to shore up the value of the yuan.

The yuan has been faced with increasing downward pressure as investors sold the currency seeking a safe haven in the US dollar amid a grim outlook for the global economy.

China held a total of US$ 1,134 billion of US Treasury debt as of October 2011. According to the US Treasury Department, China accounted for approximately 24% of total foreign holdings of US debt. Despite this latest cut, China remains the largest foreign holder of US treasuries.

Analysts advocate China should continue to accelerate the diversification of its US$ 3.2 trillion foreign-exchange reserves, amid growing global financial uncertainty. Currently, about one-third of China's foreign-exchange reserves is invested in US Treasury bonds.

The PBOC has been reported it's planning to create a fund worth US$ 300 billion to invest the country's foreign-exchange reserves in the US and European markets. The fund will reportedly seek to invest in real assets and company shares, rather than government securities.

Gao Xiqing, vice-chairman of China Investment Corp, the country's sovereign wealth fund, said recently that the fund is actively looking for investment opportunities in infrastructure projects in countries including Britain, the US, and Brazil.

Labels:

china,

us debt,

US treasury bonds

Thursday 8 December 2011

Stockmarket volatility...biggest historic moves in the Dow Jones index

The five largest one day percentage and points up moves in the history of the Dow Jones Industrial average all occurred during a bear market.

It does appear odd. Surely the biggest up moves should happen in bull markets, not bear markets. Right?

Do remember that the market continually tries to fool as many people as it can. In bear markets, everyone is looking to buy the bottom, whereas in bull markets, everyone is looking to sell the top. Bull and bear markets can't happen without this phenomenon coming into play.

That's tantalising...with the current Eurozone woes and United States' unresolved fiscal deficit issues, volatility is here to stay.

Sunday 4 December 2011

2011 China grain harvest rises for the eighth consecutive year

The China National Bureau of Statistics office released in a statement on Friday the country achieved another bumper agricultural harvest this year, the eighth

consecutive year of growth for grain output and a record for food

production.

Agricultural experts said the bumper harvest will help ease the country's food price hikes, facilitating the government's efforts to combat the stubbornly high inflation rate (official October CPI was +5.5% ). However, China's robust demand means the increased grain production is unlikely to check the country's growing imports, particularly for corn.

Bumper yields this year saw food output rising to a record 571 million tons, registering a 4.5 percent increase year-on-year. The production volume has already reached the government's grain output target for 2020, the bureau said.

Major Crops Tonnes (millions) Annual increase

Rice 200 + 2.6%

Wheat 118 + 2.4%

Corn 192 + 8.2%

Sub-total 510

Others 61

Total 571 + 4.5%

As China's urbanization process deepened, Chinese families consumed more meat in their daily diet, generating extra demand for corn as animal feed.

Meanwhile, industrial demand for starch and ethanol also increased, imposing upward pressure on corn imports. During the first nine months of this year, China imported 645,000 tons of corn according to data from grain.gov.cn, a website operated by the China National Grain and Oils Information Center.

In July, China ordered 533,000 tons of corn for delivery after August from the United States, according to the US Department of Agriculture, exceeding US estimates for Chinese's corn imports for the whole year.

Agricultural experts said the bumper harvest will help ease the country's food price hikes, facilitating the government's efforts to combat the stubbornly high inflation rate (official October CPI was +5.5% ). However, China's robust demand means the increased grain production is unlikely to check the country's growing imports, particularly for corn.

Bumper yields this year saw food output rising to a record 571 million tons, registering a 4.5 percent increase year-on-year. The production volume has already reached the government's grain output target for 2020, the bureau said.

Major Crops Tonnes (millions) Annual increase

Rice 200 + 2.6%

Wheat 118 + 2.4%

Corn 192 + 8.2%

Sub-total 510

Others 61

Total 571 + 4.5%

As China's urbanization process deepened, Chinese families consumed more meat in their daily diet, generating extra demand for corn as animal feed.

Meanwhile, industrial demand for starch and ethanol also increased, imposing upward pressure on corn imports. During the first nine months of this year, China imported 645,000 tons of corn according to data from grain.gov.cn, a website operated by the China National Grain and Oils Information Center.

In July, China ordered 533,000 tons of corn for delivery after August from the United States, according to the US Department of Agriculture, exceeding US estimates for Chinese's corn imports for the whole year.

Labels:

agriculture,

china,

grain

Tuesday 29 November 2011

2011 & 2012 calendar schedule of Euro maturing sovereign bonds

“These are hopelessly unsustainable yields and reflect the panic that is enveloping the euro zone,” Nicholas Spiro, managing director of Spiro Sovereign Strategy in London, said.

France has Euro 177bn, Italy 170bn and Spain 167bn bonds maturing which need to be refinanced through first quarter 2012. These do not include the additional new issues to finance the 2012 fiscal deficits likely to be incurred...

With too high a price to pay and so much maturing imminently... you are looking at an unstoppable freight train, with lights flashing and horns blaring about to hit the buffers. Do not let your investments get caught in the middle of the level crossing...this is the time to seriously consider precious metals like gold and silver.

Saturday 19 November 2011

Interactive Graphic on Worldwide Bank Debt - Who owes what to whom?

Click on image above to enlarge view

Click and visit this interactive link below to find out who owes what to whom...let's annex some respite from the relentless daily drumbeats of a worldwide financial edifice on the verge of collapse...winter maybe on its way but it doesn't mean we cannot have some light-hearted fun...

Source BBC News: Debt Web - Who owes what to whom?

These insightful graphics from the British Broadcasting Corporation valiantly attempt to peel away the layers of national banking debt each of the major world economies is owed from another.

I want to believe Santa Claus has a distant cousin somewhere in Harbin...

Notes on the data:

The Bank for International Settlements data, represented by the proportional arrows, shows what banks in one country are owed by debtors - both government and private - in another country. It does not include non-bank debts. Only key eurozone debtors and their top creditors are shown. Although China is known to hold European debt, no comprehensive figures are available.

GDP figures are the latest complete 2010 figures from the IMF. The percentage of gross government debt to GDP is also the latest IMF calculation.

Overall foreign (or gross external) debt is taken from the latest 2011 World Bank/IMF figures and includes all debt owed overseas, including that owed by governments, monetary authorities, banks and companies.

Gross foreign debt per person is calculated using the latest medium variant population figures from the UN Population Division.

Wednesday 16 November 2011

A brief history of worldwide house price trends 1970 - 2008

Double click on image to enlarge view

The striking aspect is the two boom cycles experienced by the United Kingdom and Netherlands in both the late 1980's and post 2001. Japan collapsed after 1991 and never recovered.

The 2000s was characterised by an era of cheap credit fueled by the Greenspan-led United States Federal Reserve which rippled worldwide that drew in Ireland, Spain and Australia. It's surreal and one wonders, within this context, the extent to which Fannie Mae and Freddie Mac were responsible for the 2008 US subprime housing bust.

The stand-out is Germany whose real house prices remained startling flat throughout most of this period...only to fall from the mid-2000s...reflecting a culture of renters and / or financial probity.

Alas, the historic data on mainland China is near impossible to obtain. The country didn't really open up fully for private enterprise until 1992. I'm sure the size of the current property bubble there will render its growth performance vis-à-vis 1970, to be off the charts.

Saturday 12 November 2011

Is 6% yield on sovereign bonds the crisis point of no return?

With Italian 10 year bonds having crossed a critical 6% yield threshold this week, it is worth seeing how other sovereign bonds behaved. Let us look at the 20 week run-up period before the crossover...

For Greece, the chart starts on September 4th, 2009, and it first crossed the 6% threshold in the week of January 15th, 2010.

For Ireland, the graph starts on May 7th, 2010 (right before the original bailout) and it breaks 6% for the first time during the week of September 10th, 2010 (around the time of EFSF announcement).

For Portugal, the graph starts on May 14th, 2010 (right before the original bailout) and it breached 6% for the first time during the week of September 17th, 2010 (around the time of EFSF announcement).

For Italy the graph starts on June 17th 2011 (before the “big” July bailout) and it just crossed the 6% threshold.

Greece broke 6% and never looked back. It had a few rallies, but never really got close to 6% again. Portugal and Ireland had similar experience until quite recently. Portugal continues to track the path first blazed by Greece. Maybe Greece is unique, but from a time series study, Portugal seems right on track to follow it. Ireland has materially turned the corner, though it hasn’t improved recently. I don’t think it is a co-incidence, that Ireland had let some financial institutions experience severe write-offs, and then it turned the corner.

It is too early to tell what path Italy will follow, but at least for the other countries, they traded similarly prior to the breach, and followed similar paths after the breach. Italy is too big, that I don’t think it can turn like Ireland did. If Italy moves much further, I think it will follow Portugal and Greece. It has more debt than Portugal, Ireland and Greece combined.

Governments do not have months to fix this, they have weeks, and they have been squandering them.

Otherwise, austerity measures will become a regular fixture of day to day living for the populace going forward.

One can anticipate protection by examining purchasing an ETF called Proshares UltraShort Euro (NYSE:EUO) which increases in value by 2% for every 1% decrease in the value of the Euro.

Click here for more info: Eurozone countries 10 year bond yield - the great unravelling

Labels:

bonds,

Greece; PIIGS; euro,

Italy

Thursday 10 November 2011

Eurozone countries 10 year bond yield history - the great unravelling

The great unraveling of the Eurozone has taken an ominous turn...bond yields have shot up in Italy as investors perceive the sovereign risk to have deteriorated. Greece, Portugal and Ireland have already floundered on the credit rocks.

Yesterday, Italy's yields acrossed the 7% Rubicon. A 7% yield is widely deemed as unsustainable and has previously led to bailouts and talk of default in smaller euro zone economies such as Portugal, Ireland and Greece. The crisis will not end simply with Berlusconi's excruciatingly slow demise. If the thinking now is that Italy also needs a bail out, there's a problem. Italy has two trillion euros of debt. That’s greater than the total amount of debt owned by Greece, Ireland, Portugal and Spain combined.

When the Euro was launched in 1999 there was much fanfare over the convergence of interest rates as sovereign risk appeared to equalise with markets not differentiating between economic fundamentals in each Eurozone nation. All started to unravel in 2008.

And, just by looking at the chart, you can tell that there's no way this implosion can be put back the way it was. If the euro is going to weaken, then the best way to play it is to buy the ProShares UltraShort Euro ETF (NYSE:EUO). Every 1% decline in the euro will move the ETF up by 2%.

Thursday 29 September 2011

US Debt in Household Budget Terms

By removing several zeros from the Government's figures and rephrasing the official terminology, one can place the debt situation in terms we all can understand - that of a family’s income and expenses.

A family taking in an annual income of $21,700 but spends $38,200 will soon be in dire straights.

The large outstanding balance of $142,710 on the credit card only exacerbates the situation.

Clearly, spending cuts need to be made, but eliminating only $385 from the family’s budget would be a drop in the bucket.

Either a substantially higher amount of income needs to be made, or the family will have to learn to live with less.

Clearly, this "family's" credit status is beyond alarming. The parents must accept the responsibility that has led up to their predicament and avoid shunting the repayments to the kids.

It's not all hopeless... in the household context, by all means start paying down the credit card debt and start managing the card company's expectations by committing to repaying an affordable amount each month. Alongside this, the long road to redemption must also start with initiating some nominal savings to weather the inevitable storms that will appear. Assets like precious metals eg silver should act as a store of value in the long term. Currently priced at around US$30 an ounce, they are worth accumulating.

Labels:

Creditors;,

US Crisis,

wealth

Saturday 17 September 2011

China's WEF warning on its US Treasury sovereign debt holdings...orderly liquidation...

China has explicitly warned the debt markets...

A key rate setter for China's central bank let slip, or was it a slip, that Beijing aims to run down its portfolio of United States debt as soon as safely practicable.

"The incremental parts of our of our foreign reserve holdings should be invested in physical assets," said Li Daokui at the World Economic Forum in the very rainy city of Dalian, formerly Port Arthur from Russian colonial days. Mr Li, one of three outside academics on China's Monetary Policy Committee, described the debt deals on Capitol Hill as "just trying to by time", saying it will not be enough to stop America's "debt dynamic" turning dangerous.

"We would like to buy stakes in Boeing, Intel, and Apple, and maybe we should invest in these types of companies in a proactive way."

"Once the US Treasury market stabilizes we can liquidate more of our holdings of Treasuries," he said.

It appears this is the first time a top adviser to China's central bank has uttered the word "liquidate". Until now the policy has been to diversify slowly by investing the fresh US$200bn, on average, accumulated each quarter into other currencies and assets, mainly AAA euro debt from Germany, France and the hard core.

It is not clear how much US debt is held by SAFE (State Administration of Foreign Exchange), the Chinese central bank's forex arm. The figure is thought to be over US$2.2 trillion. What's clear is a large vexed seller is agog to let go.

The relevant ETF (NYSE: TBT) to capture this directional move, as confidence in US Treasuries slowly erodes, is the ProShares UltraShort 20+ Year Treasury; it seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Bond Index (the Index).

A key rate setter for China's central bank let slip, or was it a slip, that Beijing aims to run down its portfolio of United States debt as soon as safely practicable.

"The incremental parts of our of our foreign reserve holdings should be invested in physical assets," said Li Daokui at the World Economic Forum in the very rainy city of Dalian, formerly Port Arthur from Russian colonial days. Mr Li, one of three outside academics on China's Monetary Policy Committee, described the debt deals on Capitol Hill as "just trying to by time", saying it will not be enough to stop America's "debt dynamic" turning dangerous.

"We would like to buy stakes in Boeing, Intel, and Apple, and maybe we should invest in these types of companies in a proactive way."

"Once the US Treasury market stabilizes we can liquidate more of our holdings of Treasuries," he said.

It appears this is the first time a top adviser to China's central bank has uttered the word "liquidate". Until now the policy has been to diversify slowly by investing the fresh US$200bn, on average, accumulated each quarter into other currencies and assets, mainly AAA euro debt from Germany, France and the hard core.

It is not clear how much US debt is held by SAFE (State Administration of Foreign Exchange), the Chinese central bank's forex arm. The figure is thought to be over US$2.2 trillion. What's clear is a large vexed seller is agog to let go.

The relevant ETF (NYSE: TBT) to capture this directional move, as confidence in US Treasuries slowly erodes, is the ProShares UltraShort 20+ Year Treasury; it seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the Barclays Capital 20+ Year U.S. Treasury Bond Index (the Index).

Monday 5 September 2011

English collective nouns…a school of fish, parliament of owls, pride of lions, Congress of baboons…making the world go round.

The English language has some delightfully anthropomorphous collective nouns for the various groups of animals.

We are all familiar with a herd of cows, a flock of chickens, a school of fish and a gaggle of geese.

However, less widely known is:

- a pride of lions,

- a murder of crows (as well as their cousins the rooks and ravens…recall the 1963 Alfred Hitchcock film "The Birds"?)

- an exaltation of larks and,

- presumably because they look so wise, a parliament of owls.

Now consider a group of baboons. They are the loudest, most dangerous, most obnoxious, most viciously aggressive and least intelligent of all primates. Ironically, what is the proper collective noun for a group of baboons? Believe it or not... a congress!

Dedicated to the politicians of the world…especially to those on both sides of the Atlantic responsible for the current global economic woes and specifically, to that collective crew in Washington DC who literally personify this noun.

Against this backdrop, with the scope for fiscal and monetary policy ammunition running desparately short and stimulus all but exhausted, politicos might be expected to grasp the nettle, overcome their squeamishness about confronting vested interests opposed to change and push through reforms to improve the supply side of the economy; policies such as making it easier to hire and fire, promoting greater competition and investing more in training.

How about the people deserving a keen "convocation of eagles" in these national legislatures...

We are all familiar with a herd of cows, a flock of chickens, a school of fish and a gaggle of geese.

However, less widely known is:

- a pride of lions,

- a murder of crows (as well as their cousins the rooks and ravens…recall the 1963 Alfred Hitchcock film "The Birds"?)

- an exaltation of larks and,

- presumably because they look so wise, a parliament of owls.

Now consider a group of baboons. They are the loudest, most dangerous, most obnoxious, most viciously aggressive and least intelligent of all primates. Ironically, what is the proper collective noun for a group of baboons? Believe it or not... a congress!

Dedicated to the politicians of the world…especially to those on both sides of the Atlantic responsible for the current global economic woes and specifically, to that collective crew in Washington DC who literally personify this noun.

Against this backdrop, with the scope for fiscal and monetary policy ammunition running desparately short and stimulus all but exhausted, politicos might be expected to grasp the nettle, overcome their squeamishness about confronting vested interests opposed to change and push through reforms to improve the supply side of the economy; policies such as making it easier to hire and fire, promoting greater competition and investing more in training.

How about the people deserving a keen "convocation of eagles" in these national legislatures...

Saturday 3 September 2011

US jobs recovery has stalled...is a Greater Depression beckoning as financial crisis continues unabated...a possible jobs solution...

Ahead of the US Labour Day holiday weekend, the Labour Department's latest employment non-farm payrolls report for August, issued yesterday, makes for grim reading showing zero job growth with unemployment transfixed at 9.1% (14 million people).

President Obama has convened an "emergency" jobs speech before a joint session of Congress on 8 September.

Recent sagging consumer confidence and skittish businesses' reluctance to hire underscore the severity of the United States situation. The impact is also felt abroad right now by Asia exporters hurt by declining trade volumes. Consumer spending represents around 70% of US GDP (about US$ 14.7 trillion in 2010).

The tremendous stockmarket rallies triggered from March 2009 as company profits recovered have not translated into additional new jobs in the US.

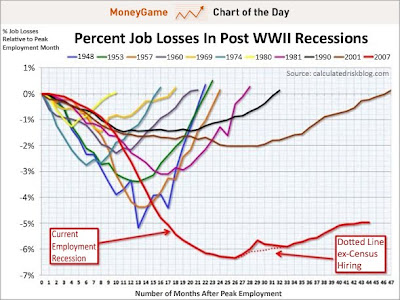

What the chart above (made by Calculated Risk) shows is the trajectory of job losses and gains over time, after employment peaked, during this recession(red line), compared to previous recessions.

So as you can see, the depth of the decline was much worse than any other recession. Furthermore, the pace of the recovery is much weaker than in previous ones. Over a year it was looking as though the recovery might be kind of V-shaped (a really big, wide V), but now it's clear that the comeback won't look anything like the decline. Now the comeback is basically flatlining. It's turning into a tilted "L".

Ironically, the only time in history that portrayed a much worse and protracted decline than the current one came about during the 1930s and 1940's Great Depression.

With current sovereign debt crises unresolved, both in the US and Europe, there is a danger of panic solutions being deployed by governments that may portend unintended consequences (eg. implementing QE3, Eurobonds) and exacerbate the uncertainty over further new job creation.

There is one possible solution which can foster job creation back in the US. Consider the current S&P500 companies' balance sheets hold cash of US$500+ billion. Unfortunately, a significant chunk of this cash is held in their overseas subsidiaries bank accounts which cannot be repatriated back to US shores, otherwise they would be immediately subject to US business tax of 35% (the 2nd highest in the world after Japan's 39.5%). Scrap this inane tax rule. Let these companies bring their hard-earned money back tax-free.

Let's do a rule of thumb calculation. Say, 40% of this cash, valued at US$200 billion, is held abroad. Repatriate this to the US and assuming dividend and share buy-back policies remain unchanged, it's all re-invested in high value IT and biotech industries, within key R&D, software / hardware manufacturing processes, where the US still retains a solid competitive advantage. That should generate 2 million critical US$100,000 jobs...and these intrinsically satisfying roles stimulate increased consumer spending (including derived demand for Asia exports), pep up family units and generate local taxes paid...

Surely it makes commercial sense to also consider relocating some of these overseas positions back to the United States than end up with incessant verbal spats over high-technology transfer agreements, patent thefts and infringements with some local partners in those testy countries...like China.

Wednesday 10 August 2011

Real Madrid bankers, Bankia, pledge Cristiano Ronaldo as collateral for more ECB funds...Moody's rate loan AAA

Bankia, banker to the world famous Spanish soccer Real Madrid, is really up against the wall amidst the current Eurozone debt crisis.

Bankia, banker to the world famous Spanish soccer Real Madrid, is really up against the wall amidst the current Eurozone debt crisis.

...very creatively, they have pledged as collateral in return for more funds from the European Central Bank (ECB), the club's loan on the Cristiano Ronaldo transfer.

The 2009 deal made Ronaldo's transfer from Manchester United to Real the most expensive footballer in history. He is one of their "galaticos" - star players. The loan has been rated AAA by Moody's.

Ronaldo now achieves the distinction of having a credit rating higher than the United States government, which was downgraded from AAA to AA+ last Friday.

Should both Bankia and Real Madrid go bust, the ECB would own Ronaldo.

Let's also hope for Bankia's sake, Cristiano doesn't suffer any serious playing injuries...like breaking his toe anytime soon...a subsequent "negative outlook with risk of downgrade" attached to the loan's credit rating would not be in the world's soccer...and economic interest.

Spanish bank fields Ronaldo as collateral - Daily Telegraph

Saturday 6 August 2011

Standard & Poors Cuts USA credit rating from AAA to AA+...Federal Reserve on the defensive...next steps?

It was the biggest open secret in Washington DC the failure to satisfactorily tackle the USA debt ceiling debate was going to trigger an urgent ratings review which had been signaled by S&P earlier this year.

It's now happened. S&P announced the downgrade on Friday night around 8.30pm EST, Saturday morning 8.30am Asia. It was a monumental moment in the history of America.

The Federal Reserve had bet the farm QE2 last August and it has lost. The worst move here would be to double-down on QE3, because if it failed to rouse global markets in a sustained fashion, then the Fed's remaining credibility and "magic" would vanish in a puff of smoke.

Would you pull out your super bazooka American Express card now to patch over the last 3 years juggling act using the Mastercard to pay off the Visa debt balance?

The perception has now changed. Interest rates around the world are going to edge up over the next 6 months as the reference price of "risk-free" rates long revered in US Treasury bills are redefined. Should central banks decide not to move interest rates up in order to manage their fragile economies, then expect a degree of foreign exchange rate volatilty.

The impact for the next 6 months will be:

QE3 will not be a panacea...more like Ben Bernanke riding to the rescue on a lame horse. Stay nimble and let the game come to you.

It's now happened. S&P announced the downgrade on Friday night around 8.30pm EST, Saturday morning 8.30am Asia. It was a monumental moment in the history of America.

The Federal Reserve had bet the farm QE2 last August and it has lost. The worst move here would be to double-down on QE3, because if it failed to rouse global markets in a sustained fashion, then the Fed's remaining credibility and "magic" would vanish in a puff of smoke.

Would you pull out your super bazooka American Express card now to patch over the last 3 years juggling act using the Mastercard to pay off the Visa debt balance?

The perception has now changed. Interest rates around the world are going to edge up over the next 6 months as the reference price of "risk-free" rates long revered in US Treasury bills are redefined. Should central banks decide not to move interest rates up in order to manage their fragile economies, then expect a degree of foreign exchange rate volatilty.

The impact for the next 6 months will be:

- The wealth effect will start to diminish as asset values become more "costly" to own and service. Will corporates and consumers continue to "pay more" and chase assets?

- Stock markets will have to rapidly adjust for and reflect the extra interest expenses within companies as debt (re)financing becomes more expensive. These are headwinds for those large leveraged companies and small businesses reliant on their bankers.

- Bonds prices trend downwards as investors rethink pricing in the context of a rising interest rate environment

- Pare down stock market portfolios to eliminate as much market risk as possible, so long as financial markets remain vulnerable, and politicians lack real impetus to resolve sovereign debt concerns. Stay with boring stable companies eg utilities that generate dependable cashflows.

- Retain a strong cash component in portfolios to take advantage of potential fire-sale opportunities. Financial markets can over-react emotioally to the downside eg Oct. 2008 & Mar. 2009 as fundamentals get tossed out of the window in panicked dashes to the exits.

- Property investors (the above-water, positive-equity universe) should consider locking in their capital gains and take a breather.

- Assess the alternative of owning precious metals...gold and silver. Historically these have provided a store of value and risk/uncertainty hedge in volatile financial climates.

QE3 will not be a panacea...more like Ben Bernanke riding to the rescue on a lame horse. Stay nimble and let the game come to you.

Labels:

credit rating,

US Crisis,

us debt

Friday 5 August 2011

S&P 500 back to March 2009 lows...in gold terms...

On March 6th 2009, the United States Standard & Poors 500 (S&P 500) index made an intraday low of 666. Gold on that day was $965. Thus, the S&P 500 bought .69 ounces of gold.

On March 6th 2009, the United States Standard & Poors 500 (S&P 500) index made an intraday low of 666. Gold on that day was $965. Thus, the S&P 500 bought .69 ounces of gold.Today, at the intraday high of gold and the low of the S&P 500, the index bought .73 ounces.

Therefore, in gold terms and/or in REAL terms as opposed to NOMINAL money terms, today’s action in the S&P 500 has propelled us basically back to the March ’09 low.

What this means is gold closing at US$1,648 today is not expensive / overvalued.

Given the choice to invest in a broad index fund or purchase gold bullion (government mint coins, private mint rounds, bars etc), albeit these do not pay interest and dividends, you can sleep peacefully without contending with all the financial markets' volatility and USA and Eurozone sovereign debt crisises.

Going forward, gold is in a bull market, it is a store of value, it's real money. The financial markets still are still rivetted with risk. I encourage you to research this and consider buying the physical stuff or a financial ETF (NYSE: GLD).

Going forward, gold is in a bull market, it is a store of value, it's real money. The financial markets still are still rivetted with risk. I encourage you to research this and consider buying the physical stuff or a financial ETF (NYSE: GLD).

Monday 1 August 2011

Are you middle class? One possible definition...

Are you middle class? Surprisingly, most people who think they are middle class, are not middle class.

Are you middle class? Surprisingly, most people who think they are middle class, are not middle class.It's refreshing to observe how enhanced global trade flows have enabled significant numbers of people in Asia to rapidly close the gap with their American and European peers.

A recent opinion on "Being middle class" at ChrisMartenson.com (a respected American economics and finance blogger) is being able to afford a dozen of the following items what most would expect a middle class family of 4 or 5 can afford:

1. Income (from job and/or investments) to financially support yourself and your family of 4 or 5 without resorting to government assistance when it comes to housing benefits, welfare assistance, etc.

2. Reasonable health insurance/health care for your family (assuming no major debilitating conditions).

3. Reasonable dental insurance/dental care for your family (cleanings, the occasional crown, braces for a kid or two, etc. with affordable deductibles).

4. Paid off all educational loans within 10 years of graduating college / university.

5. Savings for retirement, around 10% to 15% or more of income put into a pension plan or other investments to cover retirement at age 65, medical expenses, possible nursing home care, etc.

6. Savings for both short- and intermediate-term goals (such as one replacement computer/notebook, television, or home appliance a year; a gently-used replacement vehicle every 7 years for each spouse).

7. Savings for long-term goals (having a 20% down payment towards the purchase of a house near where you currently live within 10 years of entering the job market, having higher education / university expenses at least half-covered within 18 years of each child's birth).

8. Kids' stuff: school clothes, tricycles/bicycles, inline skates or other sports equipment, uniforms or musical instruments, allowances, help with a used car when they reach driving age, etc.

9. A family vacation for a week, at least once every year or two; a family vacation for a week at least 2,000 miles away, at least once every 5 years.

10. Taking the family out to a decent restaurant (not Pizzahut) at least once per week.

11. Some new clothes and shoes each year - no need to shop for second-hand clothes.

12. Debt-free except mortgage - i.e. credit cards completely paid off every month (or at most three months).

For Asia, I would add being able to employ a live-in maid to run a domestic household while one or both spouses are at work.

If you:

- are on government assistance,

- have delayed health care or dental care because of costs,

- cannot save 10% to 15% of your income towards retirement costs,

- are not able to save the equivalent of a 20% down payment towards a house (yes I understand you may not want to own, but you know the directional goal I'm driving towards),

- cannot afford to take vacations,

- are not able to pay off your credit card every month, etc.

then you're really not what traditionally would be defined as middle class. You're struggling or you're working class or lower middle class. Even if you might have an iPhone or some of the latest fashions, you're really deluding yourself.

This goes double if both spouses work and such a lifestyle still can't be afforded. Over 50 years ago, most middle class women in the United States and western Europe didn't even work outside the home.

Obviously, we are looking at financial behavioural traits here instead of focussing on absolute income thresholds, since cost of living indices vary across different countries.

However, when it comes down to the crunch, strong leading middle class indicators include the capacity to save for a down payment on a home, deploy an emergency fund, build up children's college funds, etc.

So feel to mention some other items that would be expected of a typical middle class family, that many who think they are middle class, actually can't afford.

Saturday 23 July 2011

The US$15 trillion debt ceiling...a graphic picture of what this debt pile looks like...

With a 2nd August deadline looming and unless Congress approves an increase in the debt ceiling, the United States government finds itself running out of cash to pay social security recipients and on the brink of defaulting on interest payments to Treasury bondholders. So just how big is the size of the US$15 trillion "credit card" hole which the government finds itself in? (ie US$15,000 billion, US$15,000,000 million)

Well, let's say it's all piled up in one place using US$100 notes...and take a few reference points like comparing it to the Statue of Liberty, an American football or soccer pitch...

Well, let's say it's all piled up in one place using US$100 notes...and take a few reference points like comparing it to the Statue of Liberty, an American football or soccer pitch...

Nope, there's not much hope of this being paid off in a hurry within this generation.

It looks like our kids and maybe, grandchildren, will have to shoulder this burden of excess in the years to come...

How to plan for and protect yourself against the implications:

Just how bad is the US$ financial crisis?

Well, let's say it's all piled up in one place using US$100 notes...and take a few reference points like comparing it to the Statue of Liberty, an American football or soccer pitch...

Well, let's say it's all piled up in one place using US$100 notes...and take a few reference points like comparing it to the Statue of Liberty, an American football or soccer pitch...Nope, there's not much hope of this being paid off in a hurry within this generation.

It looks like our kids and maybe, grandchildren, will have to shoulder this burden of excess in the years to come...

How to plan for and protect yourself against the implications:

Just how bad is the US$ financial crisis?

What US$ 1 trillion in US$100 notes look like?

Sunday 17 July 2011

The 1st China-US Governors Forum paves the way for closer bilateral trade and economic ties in Sino-Chinese relations...

The first ever China-US Governors Forum opened at Salt Lake City on 14th July. Its purpose is to provide a new platform in promoting cooperation between the two sides in areas of trade, investment, energy, environment and people to people exchanges.

With the full backing of both Presidents Hu and Obama, it is jointly organized by the Chinese People's Association for Friendship with Foreign Countries (CPAFFC) and the National Governors Association (NGA) of the United States. This venture was instigated by President Hu in his January visit to the United States to enhance cooperation at the local level between the two countries.

The Chinese delegation led by the Zhejiang provincial Communist party secretary Zhao Hongzhu plus leaders from a number of Chinese provincial leaders including from Anhui, Qinghai, Yunnan and Zhejiang and over 30 US governors attended the forum. CPAFFC and NGA signed a Memorandum of Understanding, pledging to make the forum a long-term fixture.

In 2010, China exports to the United States totalled US$364 billion. This compared with US exports to China of US$91 billion. Last year, exports from 24 states to China exceeded US$ 1 billion. Over the past decade, 47 US states' exports to China have grown over 100 percent.

The conference attracted a few hundred researchers and entrepreneurs from local universities, businesses and other institutions in China and the US, as they explore opportunities for new joint projects to promote trade and business, education, cultural exchanges and tourism.

According to the China Daily, this was not just a talk-fest...20 deals were inked including:

- Starbucks and Aini Group in Yunnan (one of the province's most established coffee operators and agricultural companies) signed an agreement to create a coffee business partnership between their two companies, to purchase and export high-quality arabica Yunnan coffee beans, as well as operate dry mills in Yunnan province.

- The Wuhu Economic and Technological Development Zone in East China's Anhui province reached a deal with NuvoSun on a project for thin film solar cells.

- The first China-Midwest (Shanghai -St. Louis) cargo air route operated by China Eastern poised to be a key trade hub will take flight in September creating 12–15,000jobs in St Louis, Missouri. This is subject to one final piece of legislation to be passed by Missouri state senators in September.

This is one dimension that has the highest potential to both promote improving economic relations and bolster closer social ties between the two countries. It dovetails with the signature state visits and summits held by both countries recently in 2009 and 2011…..where the almost obligatory mega-deals are penned eg Boeing planes, Caterpillar mining and construction equipment.

Casting aside any political rivalries and military tensions between the world's top two nations by GDP, it’s one small step for bilateral trade and a giant stride for Sino-US commerce.

With the full backing of both Presidents Hu and Obama, it is jointly organized by the Chinese People's Association for Friendship with Foreign Countries (CPAFFC) and the National Governors Association (NGA) of the United States. This venture was instigated by President Hu in his January visit to the United States to enhance cooperation at the local level between the two countries.

The Chinese delegation led by the Zhejiang provincial Communist party secretary Zhao Hongzhu plus leaders from a number of Chinese provincial leaders including from Anhui, Qinghai, Yunnan and Zhejiang and over 30 US governors attended the forum. CPAFFC and NGA signed a Memorandum of Understanding, pledging to make the forum a long-term fixture.

In 2010, China exports to the United States totalled US$364 billion. This compared with US exports to China of US$91 billion. Last year, exports from 24 states to China exceeded US$ 1 billion. Over the past decade, 47 US states' exports to China have grown over 100 percent.

The conference attracted a few hundred researchers and entrepreneurs from local universities, businesses and other institutions in China and the US, as they explore opportunities for new joint projects to promote trade and business, education, cultural exchanges and tourism.

According to the China Daily, this was not just a talk-fest...20 deals were inked including:

- Starbucks and Aini Group in Yunnan (one of the province's most established coffee operators and agricultural companies) signed an agreement to create a coffee business partnership between their two companies, to purchase and export high-quality arabica Yunnan coffee beans, as well as operate dry mills in Yunnan province.

- The Wuhu Economic and Technological Development Zone in East China's Anhui province reached a deal with NuvoSun on a project for thin film solar cells.

- The first China-Midwest (Shanghai -St. Louis) cargo air route operated by China Eastern poised to be a key trade hub will take flight in September creating 12–15,000jobs in St Louis, Missouri. This is subject to one final piece of legislation to be passed by Missouri state senators in September.

This is one dimension that has the highest potential to both promote improving economic relations and bolster closer social ties between the two countries. It dovetails with the signature state visits and summits held by both countries recently in 2009 and 2011…..where the almost obligatory mega-deals are penned eg Boeing planes, Caterpillar mining and construction equipment.

Casting aside any political rivalries and military tensions between the world's top two nations by GDP, it’s one small step for bilateral trade and a giant stride for Sino-US commerce.

Saturday 2 July 2011

China's new Shanghai to Beijing high-speed rail link opens on 30 June...plane wins on time but does not beat cost, comfort and convenience

Thursday, 30 June 2011, the eve of the 90th anniversary of the 1 July founding of the Chinese Communist Party, was a historic day marking the inauguration of the newly built Shanghai to Beijing high speed rail link (HSR - 国高速铁路).

Work began in April 2008 and it was completed ahead of schedule at a total cost of RMB221 billion (US$28bn). The HSR is expected to have a top speed of 300km per hour along the 1,318km route, punctuated by 22 stations with 23 trains running daily in both directions.

Linking the mainland's economic and political hubs, both cities are both currently plagued by gridlocked city centres due to the recent rapid economic growth in China and the relentless increase of middle class car ownership.

A point to point, time and cost test comparing the new hi-speed rail service with an airliner was carried out by two intrepid South China Morning Post reporters on the day. So, how long would it take to reach the downtown Beijing bureau from their central Shanghai office? Will hi-speed rail drastically cut into the time savings from flying. The results highlighted above are pleasantly surprising.

Unless one is seriously time constrained, it makes sense with some forward planning, to just hop on the express, sit back, kick off your heels, and bask in comfort watching the landscape roll by.

If this exercise is anything to go by, HSR for the 1,318km journey is a serious challenger to flying. If the original plan to run the trains at 350km per hour had forged ahead, this would have killed off the airlines slashing the rail journey to around four hours. However, reasons such as affordable pricing, increasing energy efficiency and potential safety factors put that to rest.

There will be long term benefits which the HSR will bring to the 2nd and 3rd tier cities along the route which includes 22 stations (eg real estate and infrastructure development).

China has the world's longest HSR network with about 8,358 km (5,193 miles) of routes in service as of January 2011 including 2,197 km (1,365 miles) of rail lines with top speeds of 350 km per hour (220 mph). Since the introduction of high-speed rail on April 18, 2007, daily ridership has grown from 237,000 in 2007 and 349,000 in 2008 to 492,000 in 2009 and 796,000 in 2010. This vision was only realised via extensive cooperation and through technology transfer agreements with foreign train makers Siemens, Bombardier and Kawasaki Heavy Industries.

Going forward, Chinese train-makers and rail builders have signed agreements to build HSRs in Turkey, Venezuela and Argentina; bidding on HSR projects in Saudi Arabia, Russia, the United States and Brazil. They are competing directly with the established European and Japanese manufacturers, and sometimes partnering with them.

Back on the train...all that remains is to iron out the glitches from the poor mobile phone reception encountered on this first day. Then the business community could really catch on...

Work began in April 2008 and it was completed ahead of schedule at a total cost of RMB221 billion (US$28bn). The HSR is expected to have a top speed of 300km per hour along the 1,318km route, punctuated by 22 stations with 23 trains running daily in both directions.

Linking the mainland's economic and political hubs, both cities are both currently plagued by gridlocked city centres due to the recent rapid economic growth in China and the relentless increase of middle class car ownership.

A point to point, time and cost test comparing the new hi-speed rail service with an airliner was carried out by two intrepid South China Morning Post reporters on the day. So, how long would it take to reach the downtown Beijing bureau from their central Shanghai office? Will hi-speed rail drastically cut into the time savings from flying. The results highlighted above are pleasantly surprising.

Unless one is seriously time constrained, it makes sense with some forward planning, to just hop on the express, sit back, kick off your heels, and bask in comfort watching the landscape roll by.

If this exercise is anything to go by, HSR for the 1,318km journey is a serious challenger to flying. If the original plan to run the trains at 350km per hour had forged ahead, this would have killed off the airlines slashing the rail journey to around four hours. However, reasons such as affordable pricing, increasing energy efficiency and potential safety factors put that to rest.

There will be long term benefits which the HSR will bring to the 2nd and 3rd tier cities along the route which includes 22 stations (eg real estate and infrastructure development).

China has the world's longest HSR network with about 8,358 km (5,193 miles) of routes in service as of January 2011 including 2,197 km (1,365 miles) of rail lines with top speeds of 350 km per hour (220 mph). Since the introduction of high-speed rail on April 18, 2007, daily ridership has grown from 237,000 in 2007 and 349,000 in 2008 to 492,000 in 2009 and 796,000 in 2010. This vision was only realised via extensive cooperation and through technology transfer agreements with foreign train makers Siemens, Bombardier and Kawasaki Heavy Industries.

Going forward, Chinese train-makers and rail builders have signed agreements to build HSRs in Turkey, Venezuela and Argentina; bidding on HSR projects in Saudi Arabia, Russia, the United States and Brazil. They are competing directly with the established European and Japanese manufacturers, and sometimes partnering with them.

Back on the train...all that remains is to iron out the glitches from the poor mobile phone reception encountered on this first day. Then the business community could really catch on...

Thursday 30 June 2011

World Bank appoints a new treasurer Madelyn Antoncic...ex-Chief Risk Officer of Lehman Bros...

The newly appointed Vice President and Treasurer of the World Bank was the Chief Risk Officer at Lehman Brothers when they went bankrupt in 2008.

Antoncic had been with them since 1999...so how much did she know about the underlying asset quality of the bank's assets before they imploded...she can't say she didn't know what was going on...can she?

World Bank Group President Robert B. Zoellick said...“Known for her forthrightness, I am delighted Madelyn is taking up this important role. She brings to the Bank an extensive background in the financial industry and a demonstrated record of leadership, innovation, and integrity.”

Antoncic holds a Ph.D. in Economics and Finance from New York University. As treasurer she will be responsible for maintaining the World Bank's high standing in financial markets and for managing an extensive client advisory, transaction, and asset management business.

It's a zany world out there across the big pond...

Antoncic had been with them since 1999...so how much did she know about the underlying asset quality of the bank's assets before they imploded...she can't say she didn't know what was going on...can she?

World Bank Group President Robert B. Zoellick said...“Known for her forthrightness, I am delighted Madelyn is taking up this important role. She brings to the Bank an extensive background in the financial industry and a demonstrated record of leadership, innovation, and integrity.”

Antoncic holds a Ph.D. in Economics and Finance from New York University. As treasurer she will be responsible for maintaining the World Bank's high standing in financial markets and for managing an extensive client advisory, transaction, and asset management business.

It's a zany world out there across the big pond...

Sunday 15 May 2011

A new Eurozone stress test... Denmark shuts its borders to immigration...

On 11 May, Denmark shocked the European Union (EU) by announcing it will install permanent stations along its frontiers to curb crime and illegal immigration. Control booths will be erected at crossings to Germany and Sweden and in harbors and airports.

This contravenes the spirit of the 1985 "Schengen Agreement" — a free-travel system that has removed compulsory passport controls between many internal borders in Europe. The Schengen Area currently consists of 25 states, all but 3 of which are members of the European Union; the non-EU members being Iceland, Norway and Switzerland.

The system has been under pressure recently with the EU Commission considering reintroducing national border controls in the face of a flood of North African immigrants. The agreement in Denmark was made to meet demands from the government's nationalistic ally, the Danish People's Party, and is expected to be approved by Parliament.

With the Arab Spring in which conflagrations blew up in Algeria, Libya and Egypt, Mediterranean border nations like Greece, Italy, Spain and Malta have also complained that the 27-nation EU has dumped its immigration issues and the costs of dealing with illegal immigrants on their backs.

Coupled with recent economic fissures appearing inside the EU and aversion by some states to come to the rescue of fellow members, the bailouts of Greece, Ireland and Portugal have already dealt a crushing blow to the euro. Spain's fate looks sealed too. With the Denmark butterfly now flapping its wings, this could be a harbinger of a wider European fragility.

Nationalism looks to be increasingly asserting itself on both the ecoonomic and social fronts...the liberal fabric of Europe is be about to be sorely tested...

This contravenes the spirit of the 1985 "Schengen Agreement" — a free-travel system that has removed compulsory passport controls between many internal borders in Europe. The Schengen Area currently consists of 25 states, all but 3 of which are members of the European Union; the non-EU members being Iceland, Norway and Switzerland.

The system has been under pressure recently with the EU Commission considering reintroducing national border controls in the face of a flood of North African immigrants. The agreement in Denmark was made to meet demands from the government's nationalistic ally, the Danish People's Party, and is expected to be approved by Parliament.

With the Arab Spring in which conflagrations blew up in Algeria, Libya and Egypt, Mediterranean border nations like Greece, Italy, Spain and Malta have also complained that the 27-nation EU has dumped its immigration issues and the costs of dealing with illegal immigrants on their backs.

Coupled with recent economic fissures appearing inside the EU and aversion by some states to come to the rescue of fellow members, the bailouts of Greece, Ireland and Portugal have already dealt a crushing blow to the euro. Spain's fate looks sealed too. With the Denmark butterfly now flapping its wings, this could be a harbinger of a wider European fragility.

Nationalism looks to be increasingly asserting itself on both the ecoonomic and social fronts...the liberal fabric of Europe is be about to be sorely tested...

Tuesday 10 May 2011

China cracks down on Unilever...for daring to raise prices.

On May 6, the Chinese Government declared it will fine Unilever RMB 2 million (US$ 308,000) for announcing in the media its intention to raise prices on a range of its consumer products. Apparently this had led to hoarding.

The National Development and Reform Commission, China’s top economic planning agency, said in a statement sales on some products surged 100 times above "normal" levels. The government has stamped its authority to control inflation as a top priority and the central bank stated on May 3 “stabilizing prices and managing inflation expectations are critical.”

The NDRC reminded China’s Price Law disallows operators from fabricating and distributing information about price increases, raising prices collectively and pushing up prices excessively. Consumer prices in China jumped 5.4% in March, the biggest increase in 32 months, exceeding the government’s 4% full-year target every month this year.

It's interesting how Unilever could respond to this in the long term as it also confronts the rising trend of commodity price. Shackled by pricing constraints, it may have to put the China business model under the microscope. To stay competitive and serve this growing market, does it need to evaluate and source from another low-cost manufacturing location within SE Asia or India? Capped and/or diminishing profit margins are not the basis of sound sustainable businesses.

The National Development and Reform Commission, China’s top economic planning agency, said in a statement sales on some products surged 100 times above "normal" levels. The government has stamped its authority to control inflation as a top priority and the central bank stated on May 3 “stabilizing prices and managing inflation expectations are critical.”

The NDRC reminded China’s Price Law disallows operators from fabricating and distributing information about price increases, raising prices collectively and pushing up prices excessively. Consumer prices in China jumped 5.4% in March, the biggest increase in 32 months, exceeding the government’s 4% full-year target every month this year.

It's interesting how Unilever could respond to this in the long term as it also confronts the rising trend of commodity price. Shackled by pricing constraints, it may have to put the China business model under the microscope. To stay competitive and serve this growing market, does it need to evaluate and source from another low-cost manufacturing location within SE Asia or India? Capped and/or diminishing profit margins are not the basis of sound sustainable businesses.

Thursday 21 April 2011

Standard & Poors Cuts USA Sovereign Credit Rating to "Negative" from "Stable"

The US ratings agencies, long discredited for kow-towing to the major Wall Street investment houses, as they led a race to the bottom in terms of assigning ratings to sophisticated and complex instruments they themselves were not able to fully understand, finally peered over the fiscal precipice on Monday with Standard & Poors opening the first salvo to admonish the US sovereign credit rating. It cut its long-term outlook on the US to "negative" from "stable." The revision sparked fears that Uncle Sam could soon surrender his coveted "AAA" rating, the cornerstone of "reserve currency" status.

I've always seen these firms as lagging indicators to the machinations in the real economy. Look at what happened in the Eurozone with Greece, Ireland and Portugal. They were late...as usual...in recognising the gargantuan sovereign fiscal risks. Maybe they don't see it as part of their remit anymore to stand up to and ruffle governments' feathers before fiscal road accidents happen. It used to be said the role of the Federal Reserve was to take away the punch bowl just as the party got swinging...with the independent ratings agencies jousting alongside in tandem. However, the pressure within these agencies to search for new sources of income compromised their high ethical standards in the quarterly earnings pressure-cooker that is Wall Street.

For most of 2011, long-term bond yields have been in a trading range between 4.375% and 4.65%. Despite the upward trajectory of QE2 money printing, an endless stream of Treasury bonds issuance and foreign buyers starting to make noises about US fiscal irresponsibilty (Brazil, Russia and China) and the Government's ability to repay, yields have remained stubbornly low.

But interest rates will have to go higher soon...the Treasury has to offer attractive yields to appeal to these overseas buyers to buy ever higher volumes. In February, PIMCO, led by bond king Bill Gross, a conservative bond stalwart, announced its exit from the US treasury market completely. That's akin to Burger King declaring they no longer will use beef in their burgers.

The opportunity to short the treasury bond market is not far off, with yields near the lowest points and pricing near the top of their trading ranges. QE2 ends on 30th June and will open up uncertainty as the market addicts develope cold turkey. Where else can one find the grease to ramp up the markets? A lucrative ETF, ProShares UltraShort 20+ Year Treasury (symbol NYSE: TBT) is a good proxy to brace for a decline in treasury prices, gaining 2% for each 1% fall in price.

I've always seen these firms as lagging indicators to the machinations in the real economy. Look at what happened in the Eurozone with Greece, Ireland and Portugal. They were late...as usual...in recognising the gargantuan sovereign fiscal risks. Maybe they don't see it as part of their remit anymore to stand up to and ruffle governments' feathers before fiscal road accidents happen. It used to be said the role of the Federal Reserve was to take away the punch bowl just as the party got swinging...with the independent ratings agencies jousting alongside in tandem. However, the pressure within these agencies to search for new sources of income compromised their high ethical standards in the quarterly earnings pressure-cooker that is Wall Street.

For most of 2011, long-term bond yields have been in a trading range between 4.375% and 4.65%. Despite the upward trajectory of QE2 money printing, an endless stream of Treasury bonds issuance and foreign buyers starting to make noises about US fiscal irresponsibilty (Brazil, Russia and China) and the Government's ability to repay, yields have remained stubbornly low.

But interest rates will have to go higher soon...the Treasury has to offer attractive yields to appeal to these overseas buyers to buy ever higher volumes. In February, PIMCO, led by bond king Bill Gross, a conservative bond stalwart, announced its exit from the US treasury market completely. That's akin to Burger King declaring they no longer will use beef in their burgers.

The opportunity to short the treasury bond market is not far off, with yields near the lowest points and pricing near the top of their trading ranges. QE2 ends on 30th June and will open up uncertainty as the market addicts develope cold turkey. Where else can one find the grease to ramp up the markets? A lucrative ETF, ProShares UltraShort 20+ Year Treasury (symbol NYSE: TBT) is a good proxy to brace for a decline in treasury prices, gaining 2% for each 1% fall in price.

Labels:

us debt,

US treasury bonds

Sunday 20 March 2011

2011 Japan Earthquake, Nuclear Accident and Economic Implications

The sixth largest earthquake ever recorded at 9.0 on 11 March in northern Japan and the ensuing tsunami plus nuclear accident at the Fukushima Daicchi is a potential game-changer to the current fragile global economic stability.

With facts still foggy a week after the event, it is not inconceivable fear starts to take over. After all, in the nuclear industry "perceptions" are everything (aka Three Mile Island 1979, Chernobyl 1986). Already some multinational companies have chartered private jets to evacuate their overseas staff from Japan.

This radiation threat can zigzag but I see the economic picture taking shape in the following direction:

1. The world watches rivetted by this destruction in an advanced economy. One reactor may be so catastrophically damaged it contaminates the whole site so rendering the permanent complete shutdown of the entire electricity generating complex. Immediate energy shortages cascade to a grinding slowdown for industries served in the local area. It will take weeks to play out.

2. Japan is a major world player. The smooth cash flows in the global economic system to this financial centre will be disrupted as Japan rethinks the rebuilding programmes for this region which will probably take several years. Initial estimates are this area generates 3% of the national output. Just-in-time manufacturing and logistics patterns can screech to a halt if there are no alternative networks available and the implications can be heavy for domestic exporters and multinational companies. For the financial players, global money movements can be disrupted as their interest rate sensitive strategies and carry trades in the country start to morph into something completely unexpected in an uprooted Japanese landscape. Already we saw drastic and unexpected G7 intervention in the yen this week.

3. Should Japanese exports plunge and imports rise for the reconstruction efforts, Japanese money flows will tend to stay onshore within Japan. They may find they cannot participate in the US Treasury auctions of which they are the world's second biggest holder. US Treasury yields will therefore start to notch up and this can have ominous implications for bondholders and governments in their debt-servicing interest payments.

4. With money ebbing away from the US Treasury auctions, already magnified by fiscal crises in Western Europe PIGS countries, questions will be raised whether another round of quantitative easing be required after the end of June. The current rising oil price due to north African tensions (another potential game-changer in Middle-East oil dynamics) does not help. Is the groundwork being "justifiably" prepared for QE3 based on this Japan crisis?

5. There could be spill-over effects into the enormous derivatives arena. This is a fast-changing financial landscape for the international big boys and any changes in the economic assumptions that underpin these assets can quickly turn them toxic.

6. Everything changes. Faster than you can believe.

The baseline is starting to shift this week. We cannot foretell whether the resulting market turbulence (Nikkei down 16.5% in two days, worst performance since 1987 crash) was just a temporary hiccup or the harbinger of bigger moves to come over the the next two months, as the economic consequences of the guargantuan task ahead for the world's leading creditor nation are digested. Japan recovered relatively quickly from the 1995 Kobe 6.9 earthquake.

After the stunning market rebounds over the last two years, it may be time to hit the sidelines by paring down the non-core holdings and move to cash.

With facts still foggy a week after the event, it is not inconceivable fear starts to take over. After all, in the nuclear industry "perceptions" are everything (aka Three Mile Island 1979, Chernobyl 1986). Already some multinational companies have chartered private jets to evacuate their overseas staff from Japan.

This radiation threat can zigzag but I see the economic picture taking shape in the following direction:

1. The world watches rivetted by this destruction in an advanced economy. One reactor may be so catastrophically damaged it contaminates the whole site so rendering the permanent complete shutdown of the entire electricity generating complex. Immediate energy shortages cascade to a grinding slowdown for industries served in the local area. It will take weeks to play out.

2. Japan is a major world player. The smooth cash flows in the global economic system to this financial centre will be disrupted as Japan rethinks the rebuilding programmes for this region which will probably take several years. Initial estimates are this area generates 3% of the national output. Just-in-time manufacturing and logistics patterns can screech to a halt if there are no alternative networks available and the implications can be heavy for domestic exporters and multinational companies. For the financial players, global money movements can be disrupted as their interest rate sensitive strategies and carry trades in the country start to morph into something completely unexpected in an uprooted Japanese landscape. Already we saw drastic and unexpected G7 intervention in the yen this week.

3. Should Japanese exports plunge and imports rise for the reconstruction efforts, Japanese money flows will tend to stay onshore within Japan. They may find they cannot participate in the US Treasury auctions of which they are the world's second biggest holder. US Treasury yields will therefore start to notch up and this can have ominous implications for bondholders and governments in their debt-servicing interest payments.

4. With money ebbing away from the US Treasury auctions, already magnified by fiscal crises in Western Europe PIGS countries, questions will be raised whether another round of quantitative easing be required after the end of June. The current rising oil price due to north African tensions (another potential game-changer in Middle-East oil dynamics) does not help. Is the groundwork being "justifiably" prepared for QE3 based on this Japan crisis?

5. There could be spill-over effects into the enormous derivatives arena. This is a fast-changing financial landscape for the international big boys and any changes in the economic assumptions that underpin these assets can quickly turn them toxic.

6. Everything changes. Faster than you can believe.

The baseline is starting to shift this week. We cannot foretell whether the resulting market turbulence (Nikkei down 16.5% in two days, worst performance since 1987 crash) was just a temporary hiccup or the harbinger of bigger moves to come over the the next two months, as the economic consequences of the guargantuan task ahead for the world's leading creditor nation are digested. Japan recovered relatively quickly from the 1995 Kobe 6.9 earthquake.

After the stunning market rebounds over the last two years, it may be time to hit the sidelines by paring down the non-core holdings and move to cash.

Labels:

earthquake,

japan,

US treasury bonds

Subscribe to:

Posts (Atom)