Saturday, 3 September 2011

US jobs recovery has stalled...is a Greater Depression beckoning as financial crisis continues unabated...a possible jobs solution...

Ahead of the US Labour Day holiday weekend, the Labour Department's latest employment non-farm payrolls report for August, issued yesterday, makes for grim reading showing zero job growth with unemployment transfixed at 9.1% (14 million people).

President Obama has convened an "emergency" jobs speech before a joint session of Congress on 8 September.

Recent sagging consumer confidence and skittish businesses' reluctance to hire underscore the severity of the United States situation. The impact is also felt abroad right now by Asia exporters hurt by declining trade volumes. Consumer spending represents around 70% of US GDP (about US$ 14.7 trillion in 2010).

The tremendous stockmarket rallies triggered from March 2009 as company profits recovered have not translated into additional new jobs in the US.

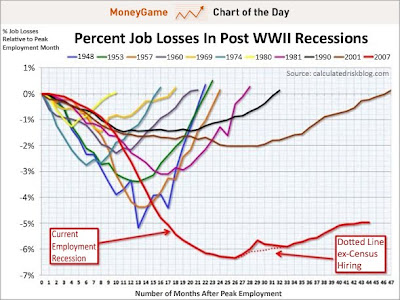

What the chart above (made by Calculated Risk) shows is the trajectory of job losses and gains over time, after employment peaked, during this recession(red line), compared to previous recessions.

So as you can see, the depth of the decline was much worse than any other recession. Furthermore, the pace of the recovery is much weaker than in previous ones. Over a year it was looking as though the recovery might be kind of V-shaped (a really big, wide V), but now it's clear that the comeback won't look anything like the decline. Now the comeback is basically flatlining. It's turning into a tilted "L".

Ironically, the only time in history that portrayed a much worse and protracted decline than the current one came about during the 1930s and 1940's Great Depression.

With current sovereign debt crises unresolved, both in the US and Europe, there is a danger of panic solutions being deployed by governments that may portend unintended consequences (eg. implementing QE3, Eurobonds) and exacerbate the uncertainty over further new job creation.

There is one possible solution which can foster job creation back in the US. Consider the current S&P500 companies' balance sheets hold cash of US$500+ billion. Unfortunately, a significant chunk of this cash is held in their overseas subsidiaries bank accounts which cannot be repatriated back to US shores, otherwise they would be immediately subject to US business tax of 35% (the 2nd highest in the world after Japan's 39.5%). Scrap this inane tax rule. Let these companies bring their hard-earned money back tax-free.

Let's do a rule of thumb calculation. Say, 40% of this cash, valued at US$200 billion, is held abroad. Repatriate this to the US and assuming dividend and share buy-back policies remain unchanged, it's all re-invested in high value IT and biotech industries, within key R&D, software / hardware manufacturing processes, where the US still retains a solid competitive advantage. That should generate 2 million critical US$100,000 jobs...and these intrinsically satisfying roles stimulate increased consumer spending (including derived demand for Asia exports), pep up family units and generate local taxes paid...

Surely it makes commercial sense to also consider relocating some of these overseas positions back to the United States than end up with incessant verbal spats over high-technology transfer agreements, patent thefts and infringements with some local partners in those testy countries...like China.

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment